The U.S. and China will cut tariffs on imports from each other as the world’s two largest economies look to reach a broader deal on trade after months of tensions.

After a single weekend meeting, the two global superpowers agreed to slash tariffs set so high that nearly all trade between the two nations stopped.

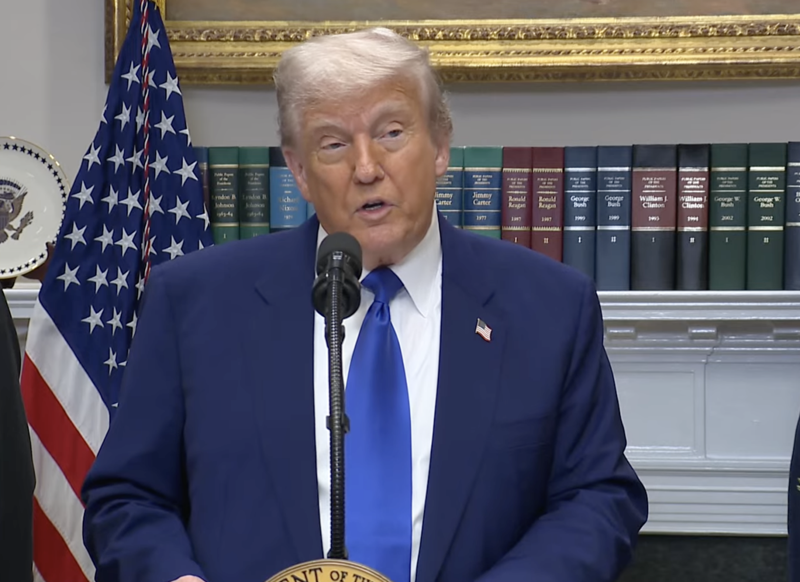

“We achieved a total reset with China after productive talks in Geneva,” Trump said Monday morning. “Both sides now agree to reduce the tariffs imposed after April 2 to 10% for 90 days as negotiators continue on the larger structural issues.”

The U.S. will reduce its tariffs on China from 145% to 30% while the two nations continue to talk. China will cut its levies on U.S. imports from 125% to 10%, according to a joint statement from the two nations. Both sides will reduce tariffs by May 14.

“We’re not looking to hurt China – China was being hurt very badly,” Trump said Monday. “They were closing up factories, they were having a lot of unrest and they were very happy to be able to do something with us.”

The U.S. goods trade deficit with China was $295.4 billion in 2024, the largest with any trading partner, according to the White House.

The two nations also will “take aggressive actions to stem the flow of fentanyl and other precursors from China to illicit drug producers in North America,” the White House said.

Trump said he plans to talk with Xi Jinping, president of the People’s Republic of China, at the end of the week. Trump said the fentanyl issue was a big part of the talks.

“They’ll be rewarded by not having to pay hundreds of billions of dollars in tariffs, so the fentanyl should stop,” Trump said. “There’s a big incentive for China to stop and I take them at their word they’re going to work on that, I think, very hard.”

Economists, businesses and many publicly traded companies have warned that tariffs could raise prices on a wide range of consumer products.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families, and pay down the national debt.

A tariff is a tax on imported goods. The importer pays the tax and can either absorb the loss or pass the cost on to consumers through higher prices.