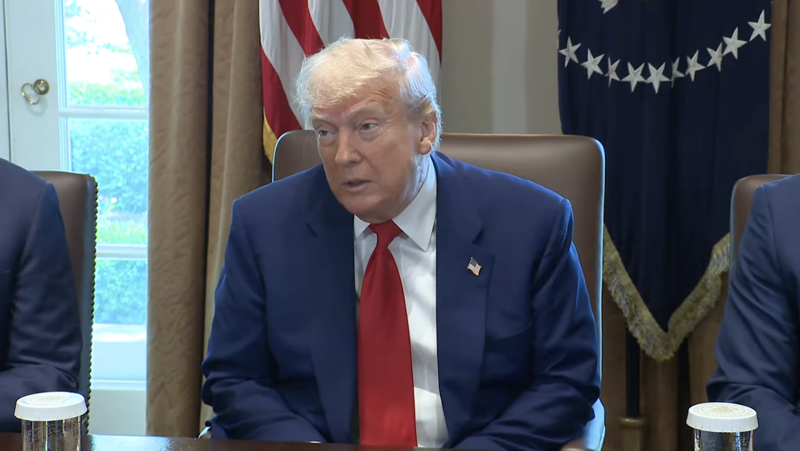

President Donald Trump said Friday that Republicans should probably avoid any tax increases, but said he’d be OK with a “tiny” one the rich.

“The problem with even a ‘TINY’ tax increase for the RICH, which I and all others would graciously accept in order to help the lower and middle income workers, is that the Radical Left Democrat Lunatics would go around screaming, ‘Read my lips,’ the fabled Quote by George Bush the Elder that is said to have cost him the Election. NO, Ross Perot cost him the Election! In any event, Republicans should probably not do it, but I’m OK if they do!!!,” Trump wrote on Truth Social.

Republicans are considering a proposal that would allow the top marginal income tax rate that’s part of the 2017 Tax Cuts and Jobs Act to expire at the end of the year for high-earning Americans. That means the rate would rise from 37% to 39.6%. Republicans would extend the 2017 tax cuts for all other tax brackets.

The Penn Wharton Budget Model found the proposal could shave off some of the $4 trillion price tag of extending the income tax rates included in the 2017 law.

PWBM looked at three scenarios:

Option 1: Extend the TCJA except for the top rate, which would revert to its 2017 level. Ordinary income above $547,000 (single) / $615,000 (married filing jointly) would be taxed at 39.6% starting in 2026. This option reduces the cost of TCJA extension by $402 billion over 10 years.Option 2: Extend the TCJA but introduce a new top rate that taxes ordinary income above $1 million at 39.6% for all filers. This option reduces the cost of TCJA extension by $222 billion over 10 years.Option 3: Extend the TCJA but introduce a new top rate that taxes ordinary income above $2.5 million ($5 million for married filing jointly) at 39.6%. This option reduces the cost of TCJA extension by $22 billion over 10 years.

Republicans have been looking for ways to pay for the tax cuts. Trump warned that any tax increase could upset the Republican base, but said he would support it.

The spending plans Republicans have pushed is not balanced and some financial watchdogs have warned the spending could send interest costs and debt soaring over the next decade.

Congress has run a deficit every year since 2001.