S&P Global, a top credit-rating agency, lowered its global economic forecasts in response to President Donald Trump’s efforts to re-order global trade with tariffs.

“The jump in U.S. import tariffs, trading partner retaliation, ongoing concessions, and subsequent market turbulence constitute a shock to the system centered on confidence and market prices,” S&P Global Ratings Global Chief Economist Paul Gruenwald said. “The real economy is sure to follow, but by how much?”

S&P Global cut its GDP growth forecasts for most countries. GDP, or gross domestic product, measures economic output. S&P also raised its inflation forecast for the U.S. It is not projecting a recession in the U.S.

“While there are increased risk to the downside across all regions and we do anticipate a material slowdown in growth, we do not foresee a U.S. recession at this juncture,” the report noted.

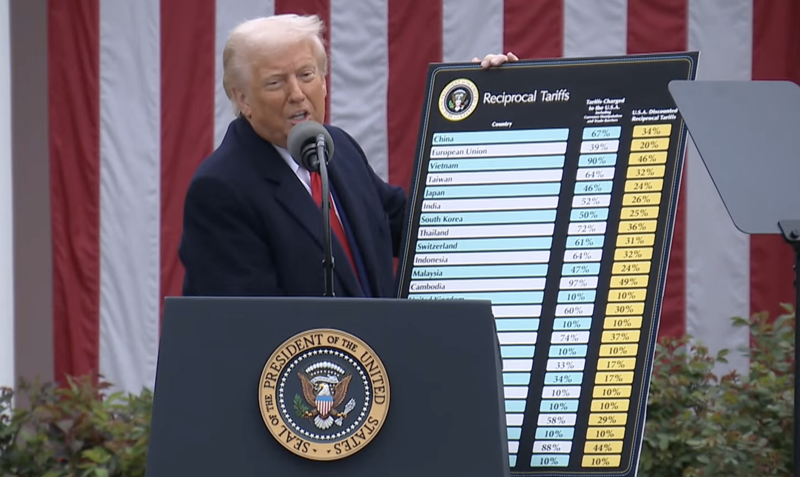

Trump announced a slate of tariffs on April 2, which he called “Liberation Day” for American trade. Seven days later, on April 9, he paused nearly all of those higher rates. Trump said the pause would last 90 days as his trade team talks with more than 75 other nations. Trump maintained a 10% baseline tariff and a 145% import duty on goods from China. He also kept tariffs on foreign-made passenger vehicles and auto parts, but Trump cushioned the blow for U.S. automakers. Tariffs on steel and aluminum also remain in place.

“The risks to our baseline remain firmly on the downside in the form of a stronger-than-anticipated spillover from the tariff shock to the real economy. The longer-term configuration of the global economy, including the role of the U.S., is also less certain,” Gruenwald said.

Global growth is 0.3 percentage points lower in 2025 and 2026 relative to S&P Global’s previous forecast round, and all regions are affected negatively.

It lowered U.S. GDP growth by about 60 basis points over 2025-2026, while Canada’s and Mexico’s GDP growth fell by similar amounts. The report projects that Germany would take the biggest hit among the major economies.

Economists, businesses and many publicly traded companies have warned that tariffs could raise prices on a wide range of consumer products.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families, and pay down the national debt.

A tariff is a tax on imported goods. The importer pays the tax and can either absorb the loss or pass the cost on to consumers through higher prices.