As Republican senators seek to incorporate their wishlist items into the One Big Beautiful Bill Act, dozens of their colleagues in the House have pledged that they won’t support a final product that neglects to offset new additions.

The multitrillion-dollar budget resolution, which barely passed the lower chamber, extends key portions of the expiring 2017 Tax Cuts and Jobs Act for the next 10 years. It also raises the debt ceiling by $4 trillion and fulfills President Donald Trump’s energy, border security and defense agenda.

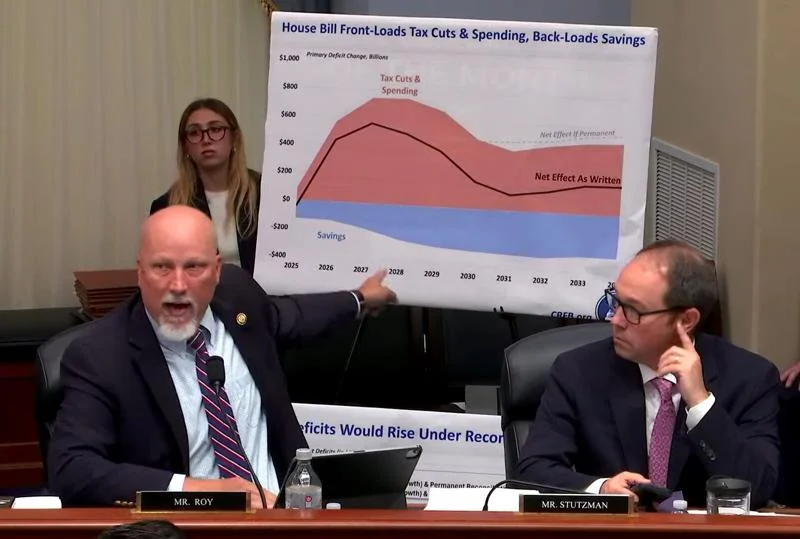

To offset the bill’s cost, House committees included roughly $1.7 trillion in savings in the package, assuming that economic growth from the tax cut extension would cover the rest.

But Senate Majority Leader John Thune, R-S.D., and others are hoping to permanently expand some business tax incentives, which would require additional offsets. Most senators also dislike the House’s reforms to Medicaid and expedited phasing out of “green” energy subsidies from the Inflation Reduction Act, both of which provide substantial savings.

If the upper chamber makes any substantial changes, however, it might disturb the delicate balance that House Speaker Mike Johnson, R-La., achieved to placate fiscal hawks in May. The most alarming possibility discussed by senators is whether to paper over the cost of extending the 2017 tax cuts by using a different scoring method.

The House operated under current law baseline, which assumes that extending current tax cuts will result in trillions of lost revenue over the next decade.

But if senators craft their addition to the bill using the unconventional current policy baseline — which would treat the tax cut extension as a continuation of current law rather than new policy — they could theoretically erase the cost of extending the tax cuts, authorizing tax cut permanence.

Nearly all budget watchdogs say the tactic would in reality cost trillions, potentially exploding the federal debt and deficit for years to come.

Sensing the danger, 38 House Republicans recently sent Thune a warning letter, threatening to tank the final product if the Senate additions are not fully offset or if the bill’s fiscal framework changes.

They encouraged their Senate colleagues to “keep the reconciliation measure compatible with the House framework while seizing every opportunity to deepen savings.” As part of that effort, they demanded that any additional tax cuts be paired with dollar-for-dollar spending reductions.

“A reconciliation bill that relaxes fiscal discipline reflected in the House-passed bill would invite higher borrowing costs and undermine the economic growth that Americans need to maximize opportunity,” the lawmakers added.

Republicans’ self-imposed deadline for passing the final product is July 4, and the Trump administration is urging them to iron out their differences as soon as possible.

Treasury Secretary Scott Bessent told House Ways and Means Committee members Wednesday that failure to pass the bill could lead to the most significant financial crisis since the Great Recession.

“I think it could set off a financial crisis the likes of which we have seen since ’08-’09,” he said.