The Senate Finance Committee’s tax and health care additions to Republicans’ multitrillion-dollar policy megabill include deal-breaking changes that have thrown congressional Republicans in disarray.

Released Monday evening, the committee’s revisions to the House-passed One Big Beautiful Bill Act (OBBBA) include making key provisions of the expiring 2017 Tax Cuts and Jobs Act permanent, rather than the House’s 10-year extension.

That includes the $15,000 maximum standard deduction for single filers and $30,000 for joint filers; the 20% Qualified Business Income deduction; and the doubled child tax credit of $2,000, though both parents now need a Social Security number to claim it and the four-year $500 boost in the House version is reduced to $200.

The committee also expanded the House’s new tax cuts for eligible seniors, increasing the $4,000 deduction to $6,000, but as with the child tax credit, taxpayers would need a social security number to claim it.

Fulfilling Republican Senate leaders’ wishes, the bill additionally makes three key business tax credits permanent – full reimbursement for new capital investments like machinery and equipment, an expanded deduction for corporation’s interest on debt, and immediate deductions for companies’ research costs. It makes the TCJA’s tax incentives for investments in disadvantaged communities, known as Opportunity Zones, permanent as well.

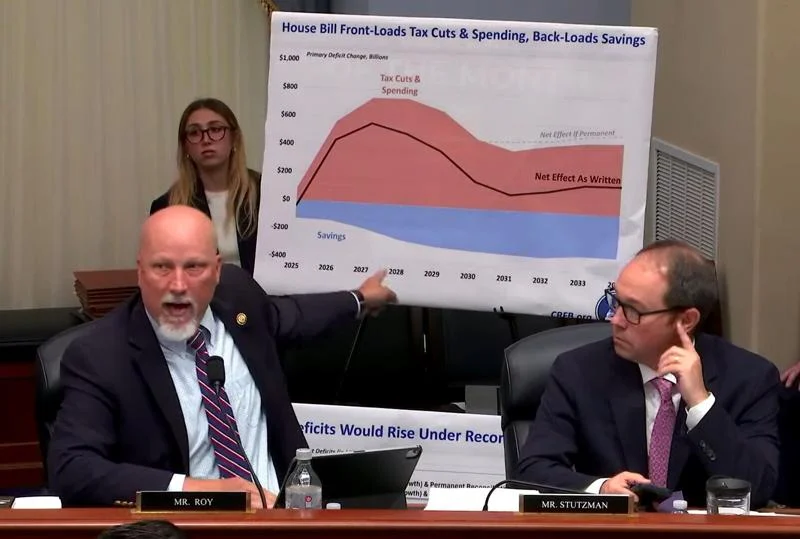

These costly extensions — coupled with an additional $1 trillion to the House’s $4 trillion debt ceiling increase and much slower phaseouts for renewable energy subsidies — have disgusted spending hawks like Rep. Chip Roy, R-Texas, and Sen. Rand Paul, R-Ky.

Roy, who reiterated Monday his demands for all Inflation Reduction Act energy subsidies to end, said he “will not vote for this [bill]” if it returns to the House in its current form. Paul concurred Tuesday.

“I voted for the tax cuts in 2017 and I’d do it again. In fact, I want to make them permanent,” Paul said on X. “But raising the debt ceiling by $5 trillion without real spending reform? Count me out.”

Fiscal hardliners aren’t the only lawmakers feeling gypped. Blue-state Republicans in the House feel betrayed as well due to the Senate Finance Committee changing their hard-fought state and local tax (SALT) provisions.

Under the Senate version of the OBBBA, the current $10,000 SALT deduction cap would be made permanent rather than rise to $40,000 as the House version stipulates. Senate Majority Leader John Thune and others have indicated, however, that the SALT provisions are a placeholder that will likely change in further negotiations.

“Everyone knows this 10K number will have to go up. And it will,” Rep. Elise Stefanik, R-N.Y., said on X.

The Senate Finance Committee’s changes to the OBBBA’s health care portions have upset a third delicate compromise House Speaker Mike Johnson, R-La., made with initial GOP holdouts in his chamber.

To help finance tax cuts permanence — the House version had only budgeted for a 10-year tax cuts extension — the committee reduced the maximum tax on Medicaid providers states can levy to 3.5%, down from the House’s 6%. Some Republicans worry that this change could harm small and rural hospitals.

Sen. Josh Hawley, R-Mo., called the plan to keep energy subsidies while defunding rural hospitals “absolutely insane” in a media interview Tuesday.

“The Senate wants to KEEP bunches of Green New Scam subsidies. And pay for it by defunding rural hospitals. All terrible ideas,” Hawley followed up in a social media post.

Though the OBBBA skirts the Senate filibuster due to rules of the budget reconciliation process, Thune may not have a majority vote if the new changes alienate too many Republicans. Even if 51 senators get on board with the final version of the bill, it still must pass the House again before reaching the president’s desk. Republican leaders have set a self-imposed July 4 deadline, which seems increasingly unlikely but still remains possible.