The U.S. Bureau of Labor Statistics released inflation numbers for August Thursday, revealing an 0.4% increase in consumer prices that exceeded projections of 0.3%.

The annual inflation rate, from August 2024 to August 2025, rose to 2.9%. The index for shelter rose 0.4%, and the more volatile consumer price categories of food and energy increased by 0.5% and 0.7%.

The Federal Reserve’s target inflation rate is 2%. After peaking at a 40-year high of 9.1% in June 2022, inflation cooled and finally dipped back into the 2% range in July 2024 at 2.9%. This year, it started at 3% in January and declined to 2.3% in April but has been ticking upward since.

August’s report was released less than one week after a weak jobs report, which reflected a major slowdown in the American job market. On Tuesday, the bureau released its downward revisions for job growth in the month of March by 911,000 – its biggest revision ever – according to The Washington Post.

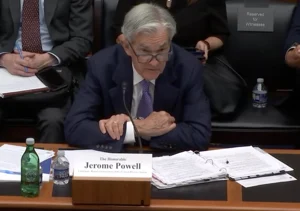

It also comes about three weeks after Fed Chair Jerome Powell indicated at an economic symposium that the central bank was considering lowering interest rates for the first time in 2025 at its September meeting, after sustained public pressure from the White House to do so.

When weighing rate changes, the Fed evaluates multiple aspects of the economy. Raising interest rates can be used to curb inflation, while lowering interest rates is often used to stimulate the economy and boost the labor market – which is why inflation that’s creeping upward while job growth appears to be stagnating can make for a difficult situation for the Fed.

“In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside – a challenging situation,” Powell said in August.

He added that the bank’s goals were “in tension” and reminded listeners of its “dual mandate” of “[fostering] maximum employment and stable prices for the American people.”

The Federal Reserve Board is scheduled to meet one week from Thursday on Sept. 16.