Senate Republicans have finally found a way to include their SNAP reforms, worth $41 billion in federal savings, within the One Big Beautiful Bill Act.

The OBBBA – a massive budget reconciliation bill implementing the president’s tax, energy, border, and defense policies – could increase federal deficits anywhere from $2.4 to $4.5 trillion over the next decade, according to most budget experts.

To offset the cost, most of which stems from the bill’s extension of the 2017 Tax Cuts and Jobs Act, House committees found roughly $1.7 trillion in spending offsets, including tens of billions by reforming SNAP eligibility requirements and funding methods.

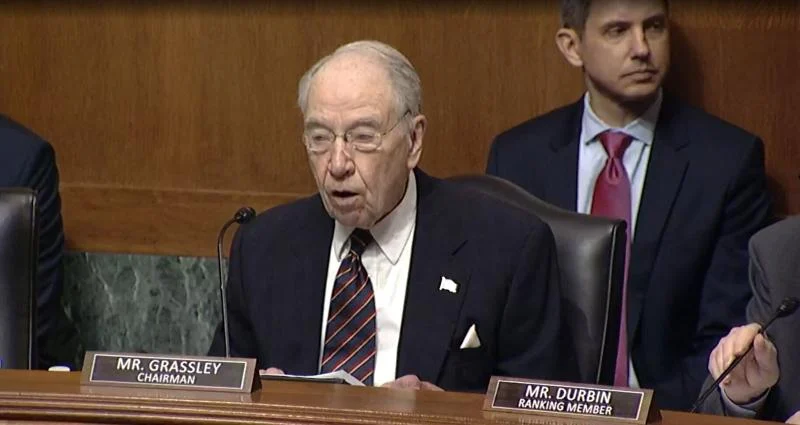

After the bill’s House passage, the Senate Committee on Agriculture, Nutrition, and Forestry revised the House’s SNAP provisions, which included closing work requirement loopholes and making all noncitizens aside from legal permanent residents ineligible for food stamps.

Most notably, the House-passed OBBBA included a provision incentivizing states to crack down on improper payments by making them shoulder a portion of the program costs. But the Senate’s SNAP changes expanded on the House’s — which required states to cover 50% of administrative costs and 5% of their SNAP benefit cost share — by hiking the state administrative cost burden to 75%.

Additionally, under the House plan, states’ benefit cost contributions would increase the higher their payment error rates, with states having an average error rate of 10% paying 25% of SNAP benefit costs. The Senate version exempted states with an error rate below 6% from this requirement and lower the 25% cost share cap to 15%

Plans changed, however, after the Senate parliamentarian ruled that the Senate’s state cost-sharing plan and immigrant restrictions violated the Byrd Rule, making the OBBBA ineligible to bypass the filibuster and pass with a majority vote.

After mild panic and a few social media rants, Republicans came back with an amended version of the SNAP reforms, which the parliamentarian approved. The updated Senate plan gives states some breathing room to states by revising which fiscal year payment error rate states can use for the cost-sharing plan. Beginning in 2028 and continuing onward, states can use their payment error rates from three fiscal years prior.

The new plan also expands both noncitizen eligibility for SNAP benefits and the populations who are exempted from work requirements.

Despite resulting in less savings than the previous legislation, the inclusion of some cost-cutting SNAP reforms left Republicans on a hopeful note.

“I’m proud of the legislation we’ve crafted that reflects Senate Republican policy priorities,” Senate ANFC Committee Chairman John Boozman, R-Ark., said in a statement. “This is a practical approach to improve SNAP by reducing waste, enhancing accountability, and encouraging recipients to move toward self-reliance through work and training.”